2024 Yearly Pakistan Real Estate Forecast | Best Investments

The Future of Pakistan Real Estate in 2024: Analysis and Predictions?

I hope you all have a happy new year, and I appreciate you being a part of Imlaak in 2023. Our goal in the Pakistan real estate projection for 2024 is to ascertain the direction that the country’s real estate market will take. Our 2023 forecasts turned out to be spot-on in terms of predicting market trends, which I’m sure makes us feel proud of the choices we made together that year.

For many years, Pakistanis around the world have considered real estate to be a major investment. Over time, it has produced significant profits. Real estate investing can yield returns of only 10% a year for the uneducated investor, but for the wise investor, it’s still the best way to build wealth. In the real estate industry, 2024 is expected to bring many new obstacles, so we must continue to follow our success methods. Real estate investments in 2024 will put your focus, patience, and disposition to the test.

The nature of real estate investing in Pakistan is changing, so our strategy has to adapt as well. The most potential real estate investment prospects in Pakistan’s real estate market in 2024 will be examined in this article.

Summary Round-Up of 2023

The year 2023 has been particularly challenging for Pakistan’s real estate market, largely due to political and economic instability, which nearly pushed the nation’s economy to the brink of default. The depreciation of the Pakistani Rupee (PKR) and rampant inflation have led to unprecedented lows in the real estate sector, particularly in the realms of plots and files. Even the construction sector witnessed diminished interest, a direct consequence of the difficult economic conditions in Pakistan.

This downturn follows a turbulent period that began in 2022. That year, significant changes in governmental policies and economic measures shaped the real estate landscape. The Government of Pakistan, under the stewardship of then Finance Minister Miftah Ismail, made clear its stance on steering the real estate market away from traditional and unproductive investments like plots, identifying them as obstacles to Pakistan’s economic progress.

In general, the real estate market in Punjab has been very volatile, whereas the market in Islamabad and Karachi has remained relatively stable. Bahria Karachi suffered badly based on rumors and news of Bahria bankruptcy, yet in general, the Karachi market remained more stable as compared to Punjab. The same can be said about Islamabad, where we have seen that the construction projects have prospered well and developed areas continued to remain stable despite a very volatile political and economic situation in Pakistan.

Without a doubt, Pakistan real estate went through one of the most disrupted and turbulent times in its history, and most people seem to have lost interest in investing during this time. A lot of capital and investments shifted towards the Dubai real estate market, which has been booming since 2022, making Pakistan the 6th largest nationality investing in the Dubai property market.

As we cannot cover every society in Pakistan, our general overview remains negative for the plots and files sector across Pakistan, with a lot of uncertainty and positive sentiment that will get stronger this year regarding income-producing properties. Below is a general guideline and important guidelines for you to keep in mind if you are planning to invest in Pakistan real estate, regardless of any particular city.

The year 2024 Real Estate Forecast Pakistan

Pakistan has a distinct set of difficulties in 2024, characterized by impending elections and a politically and economically unstable environment. For investors, particularly those in the real estate industry, this year is critical since it offers both possibilities and problems. Let us examine where to put your real estate money during these turbulent times, with an emphasis on the outlook in light of the impending IMF rescue package, foreign investments, and the post-COVID global economic recovery.

Foreign Direct Investments and IMF Package

In the present economic scenario, 2024 will be crucial for Pakistan. Political and economic stability might not be a given with elections coming up. Nonetheless, there are bright spots: an IMF bailout package and the anticipated flood of foreign investments are projected to give the economy a little boost. Pakistan is projected to benefit somewhat if global economies begin to recover from post-COVID inflation and financial difficulties.

Interest rates and the Reasons for Investing

The anticipated decline in interest rates in 2024 is a noteworthy event. It’s a great moment to look into real estate prospects because this scenario is likely to encourage more people to invest.

The Seventh Amendment’s 7E Effect on Non-Constructed Properties

The likely chances of continuation of the 7E tax, often known as the presumed rental income tax, is a noteworthy change to the real estate tax system. In 2024, it is anticipated that this tax will be applied more strictly, which will affect unbuilt properties. This alteration highlights the necessity of making strategic changes to investment decisions because it may have an impact on how desirable it is to own undeveloped land.

Impact of Capital Gain Tax Brackets

The capital gain tax brackets for different real estate sectors are going to impact investor decisions in 2024. Plots that have the highest capital gains tax time bracket of 6 years are likely to be impacted, whereas high-rise apartments where the capital gains are only applicable for 2 years will attract more investments.

Where not to invest in 2024

Purchasing properties that don’t immediately create cash flow, like files and empty plots, can be less lucrative for a number of reasons.

No Immediate Returns: These investments don’t yield a consistent income like rental properties do, which can be problematic during recessions.

Vulnerability to Market Fluctuations: Due to their greater sensitivity to market fluctuations, these traits carry a higher risk when the economy is uncertain.

Liquidity Issues: It could be difficult to swiftly sell these assets at a fair price during hard times.

Costs of upkeep and security: The ownership of undeveloped land frequently entails continuous maintenance and security requirements, with little revenue to defray these costs.

Impact of New Tax Regulations: Because of the increased tax burden brought on by the introduction of levies such as the 7E tax, owning undeveloped real estate loses financial appeal.

Where to invest in 2024

When the economy is struggling, rental income assets become an attractive option for investors. This is the reason why:

Consistent Cash Flow: During erratic economic times, rental properties offer a reliable source of revenue.

Resilience to Market Fluctuations: Rental income is less susceptible to transient changes in the market than assets that are linked to the market.

Long-term Appreciation: Real estate frequently increases in value over time, providing both rental income and appreciation.

Inflation hedge: Rental incomes typically increase in tandem with inflation, providing a buffer against the depreciation of purchasing power.

Apartments, high-rises, and constructed properties: A wise investment

Constructed properties, especially highrise flats, are especially appealing in the current economic climate for a number of reasons, including:

Investment Threshold: As the prices of commercial properties have risen too high, the apartment remains the best choice for investors looking for a rental income option with less investment as compared to houses and commercials.

Installment Options: The option to pay over 3–4 years is widely available in the case of apartments, and it is much easier for investors to start small by paying on 20–30% downpayment.

High Rental ROI: Apartments offer a higher rental ROI than commercial properties, ranging from 6 to 10 % on long-term and up to 15% through short-term rental management, depending on the properties and rental management option.

Tax Benefits: To promote highrise and construction projects, the government has imposed low taxes, including a time limit of only 2 years for capital gain tax after which you do not have to pay any capital gain taxes.

Reduced Maintenance: Apartments usually require less maintenance than single-family homes, which makes them desirable in recessionary times.

Attractive to Tenants: Apartments frequently have appealing facilities and security features, which draw in new renters and maintain a steady stream of business.

Scalability: Purchasing apartments enables investors to effectively scale their investment portfolio by allowing them to own several units in the same building.

Agriculture Land

Stability in an Economy Based on Agriculture: Pakistan’s economy is heavily dependent on agriculture, which generates a sizable percentage of the country’s GDP and employs a sizable fraction of the labor force. In an economy like this, owning agricultural land provides security because the industry frequently bounces back from downturns.

Protect Yourself From Inflation: Land used for agriculture might be a good way to protect against inflation. The value of agricultural land and the commodities produced often rise in tandem with the pricing of goods and services.

Demand for Agricultural Products Is Constant: Pakistan’s economy is primarily agrarian, hence there is a constant need for agricultural products. Landowners may benefit from a certain amount of financial stability due to this steady demand because food production is always necessary, regardless of the state of the economy.

Opportunities for Rental Income: Tenant farmers are leased land by a large number of Pakistani landowners. This can be a reliable source of income, especially during difficult economic times when other sources may be jeopardized.

Tax Benefits and Government Incentives: The Pakistani government frequently offers tax breaks and support for a range of farming operations, among other incentives and subsidies, to the agricultural sector. The financial viability of owning agricultural property may increase with these incentives.

Although Pakistan may face its share of difficulties in 2024, there will also be possibilities for wise real estate investments. Investing in rental income assets, especially high-rise flats or agricultural land, can offer investors consistent profits and a safeguard against fluctuations in the economy. Like any investment, it’s critical to carry out in-depth research and potentially speak with a real estate specialist in order to make well-informed choices that are suited to each person’s financial objectives and risk tolerance.

Recommended Apartment/Highrise Project in Pakistan to Invest in 2024

Sixty6 Gulberg Luxury Serviced / Hotel Apartments in Gulberg, Lahore

Sixty6 Gulberg has accomplished a major milestone with the timely completion of its grey construction, one year after our initial projection in the 1 crore challenge. With a further 50% gain predicted by the time the project is delivered in the first half of 2025.

Imperium Developers’ Sixty6 Gulberg features a selection of hotel-style apartments with one or two bedrooms as well as a select few three-bedroom penthouses that are ideal for short-term rental management.

This project is notable for being the first smart rental building in Pakistan and for being the standard for serviced and hotel apartments in Lahore.

Designed as a fully hybrid model, Sixty6 Gulberg offers a five-star living environment. With three fine-dining restaurants, an elegant coffee and pastry shop, a fitness bar, and a cigar club, among other opulent amenities, it offers something for every taste of its residents and visitors.

In addition, the building’s design maximizes rental income for the building’s owners. It presents a novel, open-access pool rental management system that is run via a cutting-edge web portal.

Due to its system, which guarantees profitability and ease of maintenance for apartment owners, Sixty6 Gulberg will be a profitable venture in the Lahore real estate market in 2024.

Green World Tower, Islamabad

All those who prefer Islamabad for investments will get an opportunity to invest in the Greenw World Tower. A landmark building by IBECHS (Intelligence Beaureu Employees Cooperative Housing Society).

This project is special not only because it is being developed through a REIT, but also owing to its location right on the Lake and offering Golf course access.

It is a 35-story-high tower that offers, 1, 2 and 3 Bed ultra-luxury apartments at an affordable price, just 15 minutes away from the Blue area.

New Life Residencia DHA Lahore

A collaborative initiative between DHA Lahore and New Life Developers, called New Life Residencia, presents itself as an appealing investment option in 2024.

This project is the first to combine the dependability and security of DHA Lahore with the flexibility of installment-based investing.

New Life Residencia, which offers 1, 2, and 3-bedroom apartments, is notable for being more reasonably priced than its rivals.

Situated in one of Lahore’s most famous neighborhoods, it guarantees excellent value for money in addition to a wonderful lifestyle.

The combination of New Life Residenica’s strategic location, affordability, and reliable reputation of DHA Lahore makes it a desirable choice for both novice and experienced investors in 2024. The installment plan makes it more affordable and accessible to a wider group of investors who want to take advantage of Lahore’s thriving real estate industry.

Goldcrest Mall and Residency, DHA Lahore

After being acquired, Goldcrest Mall and Residency both continued to prosper. For investors who purchased this project in 2018 or 2019, the apartments provide a rental yield of over 15%.

If you are looking for a rental property in possession, Goldcrest Mall offers the best returns in Lahore. A one-bed rental costs more than one lac, while a two-bed rental might cost up to 2.5 lacs.

The play area is opening in January 2024, and the cinema has been signed and will open before June 2024. These, along with the food court and brands opening up on the first floor, are going to be a game-changing year for the commercials in Goldcrest.

Downtown Mall & Residences Gulberg Lahore

Downtown Mall Liberty is expected to be in possession by June 2024. Rental revenue and capital gains are promising for the project, despite delays. The real estate industry has reached a milestone as property values rise above 45,000 PKR per sqft. This tremendous price appreciation shows the property’s potential and worth.

Downtown Mall hotel rooms are a good investment in these prices. This is much cheaper than Gulberg projects at 55,000–65,000 PKR per sqft. Investors seeking high profits in the next few years might consider Downtown Mall due to its strategic position and competitive pricing.

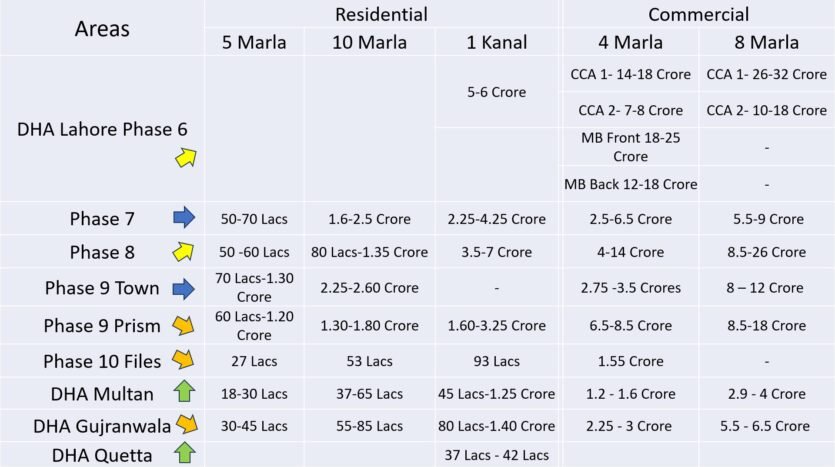

DHA Lahore Year 2024 Pakistan Real Estate Forecast

Further market corrections in underdeveloped areas are expected in 2024. Political instability, upcoming elections, and government policies against plot and file investments may cause further

Corrections can reveal great long-term investment opportunities. However, we’re going through a downturn cycle, so we must choose investments carefully.

For end-users seeking to build homes in the next few years, 2024 offers many opportunities to buy plots at low costs.

Expatriates may benefit from investing in Pakistan’s real estate market in 2024. With the USD strong and plot prices falling, expatriates can capitalize on these market conditions.

Remain tuned for any trading opportunities in the residential plot sector that may arise during 2023.

DHA Lahore Phase 9 Town

9 town DHA Lahore prices have been generally stable, with a slight correction. A lot of houses have been constructed in 9 town, and a new non-possession area is also available, with prices ranging from 5 M to 6 M for a 5-Marla plot.

I do not see any investor interest in 9 Town in 2024.

CCA 1 and E block commercial: Have not really developed so far except a few grocery shops in CCA 1 and is not going to show a major upside in 2024 and therefore not recommended for investments.

DHA Lahore Phase 7

DHA Lahore Phase 7 is now almost 15% occupied and is the most attractive area for end users looking to build a house at lower prices.

McDonald’s is already operating in Y Block, and Carrefour is under construction.

In 2024, I see the prices generally stable and not much investor interest.

CCA 1–6: Phase 7 commercials are generally average commercials that do not generate very good rental returns except Q block, which has developed to some extent. It is still going to take some time before we see these commercials performing, and 2024 is not the year.

DHA Lahore Phase 6

Phase 6 of DHA Lahore is the best area if you are looking for rental income in 2024.

The 2 Kanal plots, especially in the L and K blocks, have shown a major upside in 2023 reaching almost 20 crores due to limited supply.

MB Commercial: The prices of main-facing commercials are at their peak and do not offer very good rental ROI. However, the commercials at the back of the main road are still going strong, with a 4% rental return per year.

DHA Ph 6 CCA 1: This commercial area offers a good rental return; however, prices are expected to remain stable with limited growth in 2024.

CCA 2: Not a huge fan of CCA 2, and it is much better to invest in CCA 1 & 2 of Phase 8 at these prices.

CCA 3: Isn’t it in Phase 7? Well, that says it; it will remain overshadowed by the commercial area of DHA Raya.

Raya Commercial: It is the excellence of DHA Lahore commercial areas and offers good rental returns; however, the prices are not expected to rise any further in 2024, The only upside we may see is in the new blocks, which are expected to be ready in 12 to 18 months, so if you are looking for some good capital gains, its time to look at Defence Raya new commercial block.

DHA Lahore Phase 8

DHA Lahore Phase 8 has retained its value despite the market correction. It is expected to remain steady in 2024. A lot of houses are being constructed in Phase 8 and it will

If you are looking for an investment for your own house or for long-term returns on plots, Phase 8 proper remains my favorite in 2024.

Z-Ivy Green is not recommended for investments in 2024.

CCA 1 & 2: The prices have stalled, and in the presence of Broadway commercials on one side and MB commercials on the other side, these sector commercials don’t seem much of an investment in 2024.

Broadway Commercials: The best commercial area of Phase 8 and is expected to become one of the biggest commercial markets of DHA Lahore in times to come, the prices are still attractive owing to a high supply in this area. However, if you are looking for stable rental income and long-term capital growth, this is the best commercial area in DHA Lahore.

DHA Lahore Phase 9 Prism

Phase 9 Prism has still got a long way to go, and the presence of much more developed phases will keep Phase 9 Prism prices under pressure this year as well. It is not recommended to invest in 9 Prism of DHA Lahore in present circumstances owing to the general negative sentiment and Government policies that deter investing in plots.

Commercial Zones: The prices are high, and this is not a feasible area to invest in at the moment, considering there are zero chances of rental income so far.

Oval Commercial: The prices haven’t changed much but are again not recommended for investment in 2024.

DHA Lahore Phase 10

If you missed the opportunity to exit as suggested in our 2023 real estate forecast, you might need to be patient for a while longer.

The real estate market in Phase 10 of DHA Lahore is still building up its pace. Should the prices reach approximately 8 to 9 million, it would be advisable to consider investing in a swift short-term transaction.

Other Cities Year 2024 Pakistan real estate forecast

Gujranwala DHA Real Estate forecast

DHA Gujranwala is not as attractive anymore, as investors have lost interest in general. Prices have come down a bit, and generally, we don’t see fast-paced development so far.

It is therefore not recommended for investment in 2024.

DHA Multan Real Estate forecast

The development speed in DHA Multan has been exemplary, and it is undergoing rapid completion. This keeps my hopes high in the coming days. The price is rock bottom at the moment, and with lots of areas in possession now, my strategy will be to invest in DHA Multan and build rental properties to hold for the long term.

This will give you great returns in the next 5 years, and you will have continuous cash flow because of rental income.

DHA Quetta Real Estate forecast

Well, DHA Quetta has hit rock bottom, and rightly so. It has set an example for those with a gambling mindset who want to make quick money from real estate.

While rock bottom, I do not recommend investing as investor confidence is shaky at the moment. However, for someone who can hold for years to come this might be the right time to invest for the long term.

Gwadar Real Estate forecast

Gwadar real estate has shown a negligible change in 2022. The low prices or any major shift towards CPEC by the government may spark the interest of investors in 2024. Although a bit risky, your money is safe as you will buy it at lower prices and can hold it for a couple of years to sell when the market rises. It will not be a surprise to me if investor focus shifts to Gwadar in 2024.

If you have a big portfolio of investments, it may be the right time to put some eggs in Gwadar for the long term.

Conclusion Pakistan Real Estate Forecast 2024

As we enter 2024, local and international economic changes are likely to have a significant impact on Pakistan’s real estate market. Investors are increasingly focusing on rental properties this year, including commercial spaces, high-rise apartments, and office buildings, as they are expected to offer the most lucrative investment opportunities

-

Increased Demand for Rentals: A significant shift toward rental properties like commercial spaces, high-rise apartments, and offices due to urbanization and lifestyle changes.

-

Long-term Approach for Plots: Investing in plots and files should be for the long haul, considering the current economic uncertainties.

-

Expatriate Opportunity: The fluctuating exchange rates make it an opportune time for expatriates to invest, especially in rental properties.

-

Rental Income Focus: Both local and overseas investors should prioritize rental properties for stable and consistent returns.

-

Installment Projects: These offer attractive capital gains and rental income, especially beneficial for expatriate investors.

-

Avoiding Speculative Trading: The high risk in the plots and files sector in 2024 suggests a shift towards more stable investments like rentals.

-

Prime Investment Locations: Focus on areas like DHA and Gulberg for high returns, particularly in commercial and luxury residential spaces.

Investors are advised to adapt to these changes by focusing on long-term, stable investments in high-rise and rental properties, particularly in premium locations.

________________________________________

Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 333 1717170 (WhatsApp)

Mob : +92 333 1616160 ( WhatsApp)

[…] compared to other Asian cities and even the property value of Karachi is a 4% decrease. In the mid of 2023, the real estate market in Islamabad had remained stable but in Punjab and Karachi the estate market […]