The Best Time and Money Relationship Hack | Building Passive Income

Creating wealth is a fairly simple relationship between time and money. Time is the most valuable commodity. There are only 24 hours in a day. Time can never be recreated or re-spent. It exists once, then it’s gone. And that’s precisely why building passive income is so important — because time is more valuable than money.

Not even the richest man in the world can replace the time that he has lost or wasted. Time most certainly does not discriminate. It is the greatest equalizer, we each have a limited amount of time and can’t purchase any more.

Time is money

Time is accredited as the most valuable commodity. So precious that you are unable to buy more. Once lost, it can never be replenished. Time is also the commodity that is most often wasted by people. Every activity we do in this world such as jobs, businesses, learning skills, building relationships, watching movies, hanging out, clubbing etc all require your time in exchange.

The average lifespan in Pakistan is 25000 days, if you are aged 40 you have already lived 14600 days and only got 10400 more days. Considering that most people work for a living, exchanging time for money, this precious commodity needs to be prioritized.

Financial freedom

Before we continue it is important to understand the concept of financial freedom.

Financial freedom means having savings, investments, and cash to afford the kind of life we desire for ourselves and our families. It means growing our passive income to enable us to retire or pursue the career and dreams we want instead of being driven by our need to earn a fixed salary each year. When you are financially free you let your money work for you rather than the other way around.

The path to financial freedom isn’t a get-rich-quick strategy. And financial freedom doesn’t mean that you’re “free” of the responsibility of handling your money well. Quite the opposite. Having complete control over your finances is the fruit of hard work, sacrifice, and time. And all of that effort is worth it!

Types of income in respect to time

There are mainly two types of income:

Active income

Active income consists of income you earn while you are working a full-time job or running a business. This type of income involves a direct exchange of money for valuable time. This involves the time you took to acquire that set of specific skills which made you suitable for that particular job or a business.

Passive income

Passive income is earnings from real estate, rental property, limited partnership, dividends, stocks, or other businesses in which a person is not actively involved. Potentially becoming more productive without spending a whole lot of the most precious commodity you have “TIME”.

The goal of passive income is to earn money while you sleep. This is how to get your assets working for you. You invest time in building something upfront that will generate income down the road with little effort on your part.

Building Passive income is the single most important factor, that the rich get richer. It’s how you detach your ability to earn from the limited time that you have in a day. With passive income, you make money while you sleep. You also make money while you’re awake. It’s automatic and simply keeps coming in.

Read Forbes list of passive income ideas

The strategy of wealth creation

For almost all people, active income is the first source of income creation. This is a direct exchange of time for money and how much money you make will depend upon your skill and time spent. However, not all of you will be able to create wealth and achieve financial freedom. That will depend on how you use this income. Will you create more liabilities buying wants and or assets that make income?

Let’s see what happens when one small step in your entire strategy can completely change the outcome. And how two people with similar active income, may end up with one achieving financial freedom and the other living paycheck to paycheck.

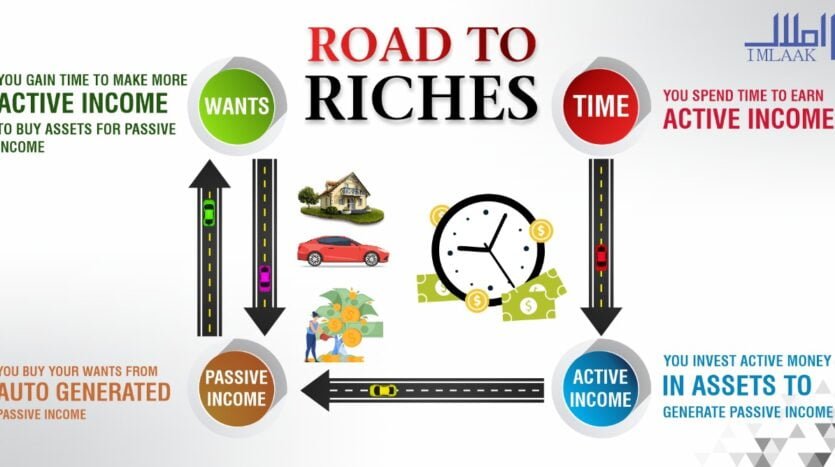

The triangle of wants

You exchange your time for active income and use the money earned to buy things that you want. A bigger house, a better car, traveling etc. In return, all these things need more of your time and money maintaining them therefore, you go back exchanging more time for more money, and continue this triangle of wants until it is too late.

Unfortunately, most people live their lives without realizing that each passing day, minute or hour, means that they have one less day, minute or hour to use. They unconsciously treat time as an infinite resource, thinking they are immortal.

Many of us get stuck in this triangle of wants, living paycheck to paycheck. And unable to save enough to build any reasonable passive income stream.

Our energy is finite, and there’s only so much you can do to become more productive. It’s far easier to stop wasting time than it is to become more productive.

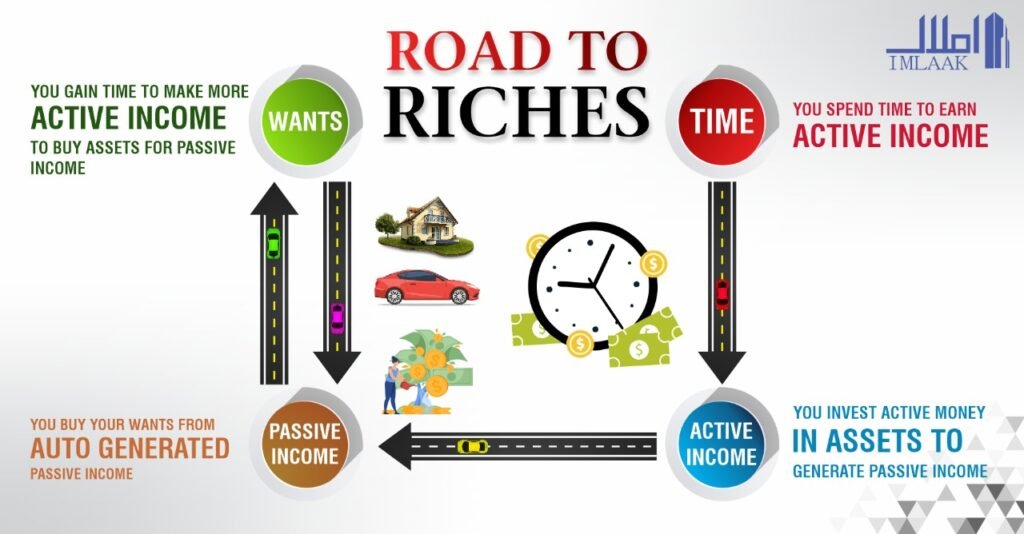

Road to Riches

Same as before you exchange your time for active income but this time use it to invest in an asset that gives you passive income. You use this passive income to fuel your wants changing one basic dynamic in the entire circle of wealth creation. Instead of buying your wants directly you are buying them and maintaining them through your passive income. A bit of patience for a while is going to become a lifetime of success and riches.

Your time is now multiplied as you make money work for you. Your passive income supports your wants consuming your money earned from auto-generated passive income assets, resultantly you gain more time. The time you have saved is then utilized to either earn more active money or build a quality lifestyle.

Eventually, you achieve the financial freedom you have always dreamed of, breaking the chains and becoming finally free.

Why is Passive Income Important

“If you don’t find a way to make money while you sleep, you will work until you die.” — Warren Buffett

The get-rich-quick virus keeps most of us engaged in activities that end up as failures. Every day I receive calls from people who want to invest in real estate with the hope to make some quick bucks believing that there’s easy money waiting to be harvested by those who know where to find it.

Nothing can be more further than the truth unless you happen to win a lottery or were born rich. There’s nothing easy about acquiring money. The only way to obtain wealth is by building a solid infrastructure and nurturing your assets.

Passive income is a cornerstone of a wealth-growth strategy. Having a solid foundation of returns that don’t require active management can keep a steady inflow of cash for your portfolio or life expenses. With a certain amount of income set on auto-pilot, you can take more aggressive investing stances elsewhere with a bit more comfort, and help hedge your profile against market volatility and economic recession.

Plus, you only have so much time to invest in making money—whether that takes the form of a job that generates income, or active money management with other investments. Once a passive investment stream is established, it’s a kind of set-it-and-forget-it asset. In short, generating wealth doesn’t take any time on your part.

CALL US NOW

Captain (Retd) Shahnawaz Yaqub Bhatti

Investment Consultant and CEO at Imlaak

Mob : +92 333 1616160 ( Whatsapp)

nice post

Your articles are always researched based I love to read

Thank you, please do share it with your friends and family to educate our community.

Right road map with right words ,

Nothing but golden words.